Household security lenders exactly what their growth depends on

Having an eye for the tall growth fueled from the prospective aversion to refinancing in the course of high interest rates, Philadelphia-mainly based household collateral bank Springtime EQ features established a pair of key enhancements so you’re able to shepherd its envisioned extension.

I have repaired-price household security finance, and in addition we has actually home collateral HELOC that gives more independence so you can the consumer

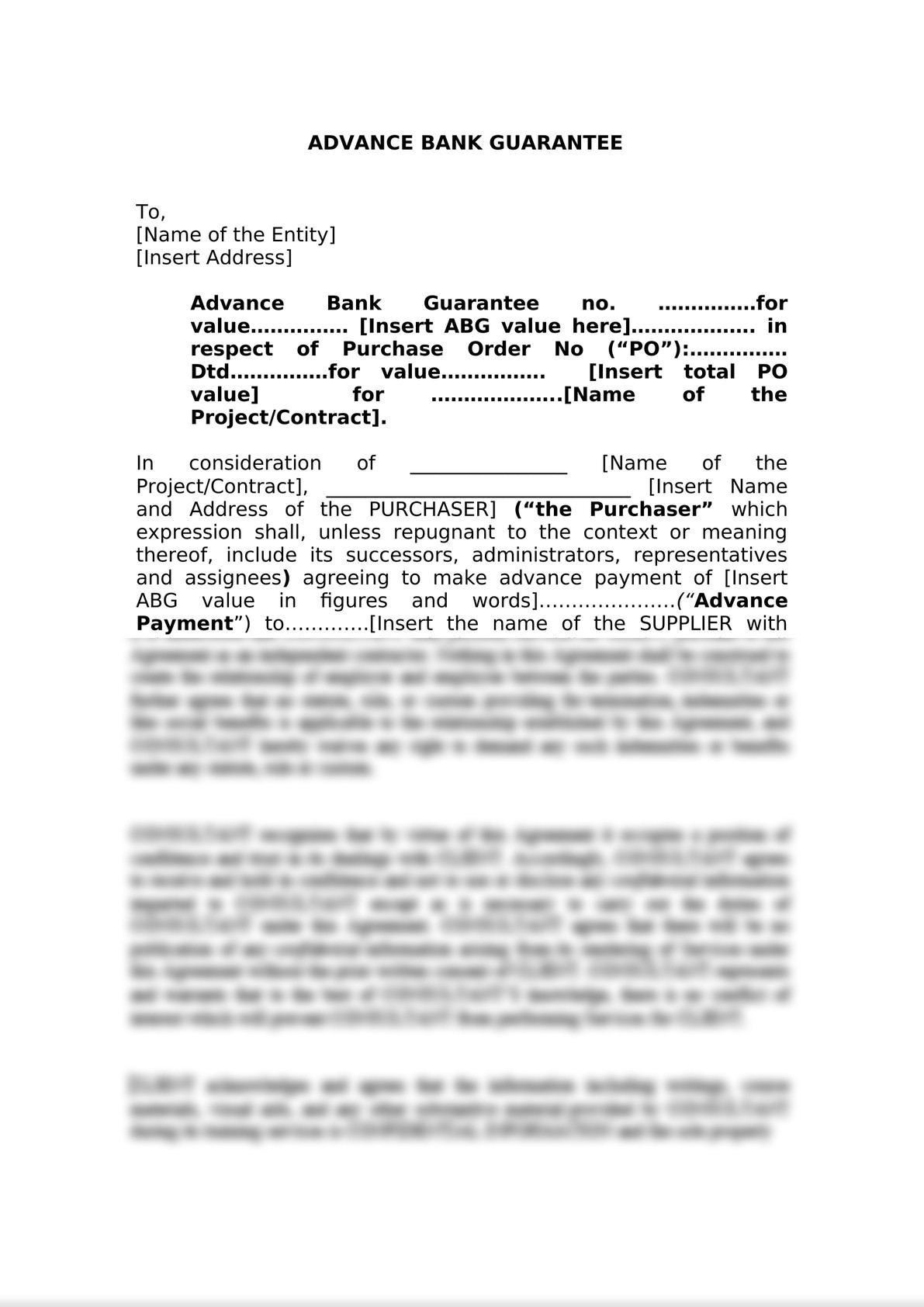

David Haggert (envisioned best best) enjoys entered the organization as the master selling officer when you’re Peter Schwartz (pictured below) was rented since the elder vp out of related financing.

In 2010, he wants further extension so you’re able to more than eight hundred staff which have a great 70% escalation in regularity in home equity providers.

The explanation for the increase for the team is through the fresh previous increase in rates, we think you to family equity financing and you may select of the all of our increasing company are becoming a lot more about essential in the long term since somebody should not refinance a highly low-rate first-mortgage, the guy told me. They would like to remain its lowest-rate first mortgage as opposed to taking dollars-out from refinancing.

Assisting where development might possibly be Haggert with well over twenty five years away from purchases knowledge of the insurance coverage and economic properties having supervision in proper planning, brand name creativity and you can lead generation perform. Haggert previously served as manager vp off lead-to-consumer product sales having Liberty Financial and captain profit officer having NewRez. The guy including held early in the day ranking having Ocwen and GMAC Mortgage easy loans Hotchkiss CO.

Plus shepherding progress could well be Schwartz, which have obligations having initiating their the fresh correspondent channel on the very first quarter in the year. In advance of signing up for Springtime EQ, Schwartz invested twenty years having Mr. Cooper/Nationstar Mortgage where the guy held numerous senior leadership ranking dealing with procedures to your organizations correspondent route, supposed up strategic effort and you will providing given that captain suggestions administrator. The guy brings thirty-five numerous years of home loan business experience in a variety out of production, repair and you may group roles, Schiano said.

When you look at the proclaiming the fresh hirings, Schiano touted one another men’s room electronic systems and you may leadership event who getting critical …from inside the delivering customized solutions for everyone kinds of home owners.

Inside the a phone interview which have Financial Top-notch The usa, Springtime EQ Ceo Jerry Schiano told you his business among the nation’s prominent non-depository loan providers emphasizing delivering family collateral lines and you will money to help you consumers experienced brisk increases a year ago, broadening so you’re able to three hundred staff regarding 230

Expected to help you expound, Schiano extra: You will find a robust products that provides users who possess lots of security and then have suits certain customers which recently purchased their home who have a little bit of collateral. So, i’ve some highest LTV [mortgage to help you value] issues available, and some traditional products. An average FICO score of our individuals is focused on 750; i go as little as 640 in some instances for customers. Our product line is really large.

But really company progress projections are now mainly contingent to your homeowner resistance so you can re-finance in the middle of forecast interest expands. Just like the future is unknown, Schiano looks positive about hedging their bets: Our company is in the a crazy go out, and it is tough to expect in which everything is supposed, the guy told you. But what I could reveal is when you take a peek at in which the first mortgage rates is actually, economists predict in the event the rates move from where it started off the entire year during the step 3-4%, that will cut in 50 % of the newest refinance business. Just what that means is consumers still need to acquire, they’re going to choose almost every other mode if they be domestic guarantee money, or unsecured loans or handmade cards. Exactly what they’re not going to carry out is actually refinancing on 2.5% very first to enter a 4% first.

When you are no-one possesses the fresh fabled amazingly ball, the fresh central bank’s telegraphing off high interest rates in the midst of inflationary tension serves as fodder in the middle of the subject his providers enjoys carved out.

There’s record house security, and there is various ways to tap domestic collateral, he said. And you may a year ago, users stolen one to using refinancing the first-mortgage. However with ascending pricing, particular people would not want to refinance their first mortgage. They will should cash-out through-other setting, and all of our product is a superb unit to help people pay off or consolidate financial obligation, so you can borrow money to improve their homes. And, plus, in certain cases our very own customers have fun with an extra home loan therefore instead of getting to help you an effective jumbo first-mortgage they are going to visit a good Fannie mae first mortgage and use our next home loan piggyback. And you may basically, that may assist them to get a better first mortgage speed.