Why does a personal loan EMI Calculator really works?

- Easy to access

- Saves date

- Brings small results

- Can help you find out their EMI

- Aids you from inside the think

Disclaimer

Axis Bank cannot verify precision, completeness or right sequence of every the main points offered therein and you will ergo no dependency should be put by representative your objective after all into the suggestions consisted of / analysis generated here or into the completeness / precision. Using one recommendations lay out is entirely within Customer’s individual exposure. User will be get it done due proper care and you can alerting (along with if required, getting regarding recommend away from taxation/ legal/ accounting/ financial/ most other experts) before you take of every choice, pretending or omitting to behave, on the basis of the pointers contained / investigation generated here. Axis Bank does not undertake people liability otherwise obligation so you’re able to modify people study. No claim (if or not inside price, tort (together with neglect) or else) should occur of or even in connection with the support against Axis Lender. Neither Axis Financial neither some of the agencies or licensors or category organizations should be prone to representative/ any alternative party, the head, secondary, incidental, special or consequential losses or damages (in addition to, rather than restriction to own death of money, business opportunity otherwise death of goodwill) anyway, whether during the package, tort, misrepresentation or else due to the aid of these power tools/ advice contained / investigation produced here.

Unsecured loan Calculator

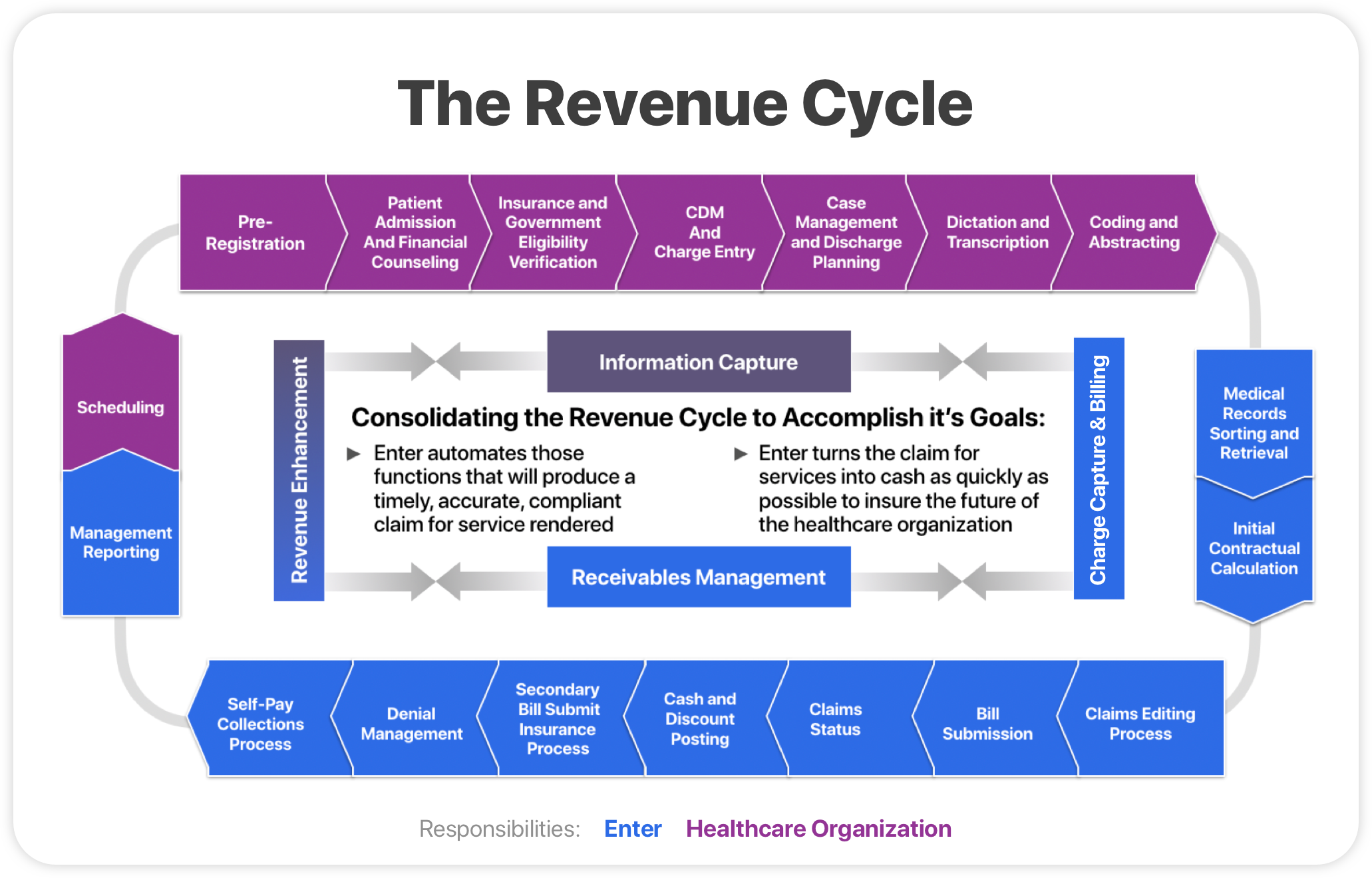

A personal bank loan calculator is actually a convenient online equipment built to assist consumers inside determining the monthly Equated Monthly obligations (EMIs) for personal Loans. Because of the inputting vital information on calculator, they utilizes the new EMI algorithm so you can compute and you can display this new monthly EMI number. While doing so, this calculator provides reveal review of the attention payable plus the total count owed on Consumer loan. helps borrowers recognize how much appeal might end up expenses, according to the various financing tenures.

The non-public Loan calculator plus provides a sense of the full matter a borrower will become spending money on the non-public mortgage, inclusive of both dominating count and you may notice amount. Complete, it will help individuals plan its earnings ideal.

A personal loan monthly EMI calculator is not difficult to make use of. This new calculator facilitate anybody select the perfect monthly loan payment amount predicated on particular parameters.

- Amount borrowed: The amount a borrower are browsing use away from an effective lender otherwise a loan company.

- Interest rate: The fresh annual rate of interest given by the lender. But also for formula motives, the newest calculator transforms they to your a month-to-month rate of interest.

- Mortgage Tenure: The cycle where the loan might possibly be repaid of the debtor towards the bank. The mortgage period is in a choice of weeks otherwise ages.

2. By inputting vital information on calculator, they makes use of brand new EMI formula so you can calculate and you can display screen the month-to-month EMI matter. At exactly the same time, that it calculator provides reveal post on the complete desire payable and the total number due to the Personal loan.

Before applying having a consumer https://availableloan.net/payday-loans-id/ loan, consumers can adjust brand new variables for the best EMI alternative to them. For-instance, a high loan amount or a shorter period increases the new EMI when you find yourself a lesser principal and you may extended cost several months wil dramatically reduce the sum of the is reduced because monthly instalments.

Formula to choose Personal bank loan EMI

The newest formula to possess calculating Equated Monthly Fees (EMI) for a loan is dependant on today’s property value new annuity algorithm. It will take into account certain parameters such prominent number, interest and you will loan tenure to estimate the latest repaired month-to-month instalment amount.

- Age ‘s the Equated Monthly Instalment

Note: Keep in mind that so it formula assumes on a predetermined interest rate throughout the financing tenure that’s maybe not right for calculating EMIs getting cutting price loans.

Benefits of using Consumer loan Calculator to possess EMI

A consumer loan Calculator to have EMI is actually a highly beneficial device. Here are the top benefits of using a consumer loan calculator for EMI: